If you don’t have an account yet…

I am not going to explain the registration process, that is pretty self explanatory, so if you don’t have an account yet and you are reading this – go sign up for one first – unless you just want to peruse what I have here in which case you are more than welcome to.

If you do have an account…

The purpose of this article is to quickly explain some of the things that are not obvious enough on the site. I will only cover securities that I myself have already dealt with, I won’t discuss any of the others because I don’t want to give out what could be cloudy or falsified information. The screen shots seen below are from the Treasury Direct website and are shown only as a visual reference. I am not a finance expert and I am not giving any investment advice, this is simply a how to.

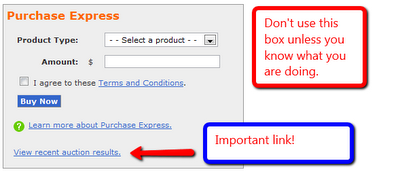

The Express Module

I don’t recommend using this module right off the bat unless you are experienced with these kinds of securities and basically you know what you are doing. If you knew what you were doing you wouldn’t be reading this How To by an amateur. I am saying not to use this module because I myself used this first when I just opened my account and I bought a 4 week bill for $100 at a 0.00% rate of return… yes you read that correctly – you can purchase bills are 0% interest.

Why the Hell do 0% Bills Exist?!

Simply put they exist because it is a safe investment for people who are looking for a safe place to store their money. People like me who don’t have tons of money and actually want a rate of return are not one of those people. If you want to do more research on this just Google for 0% treasury bills. There are plenty of articles on it, I just happened to learn about it the hard way. In fact here is my email to the treasury when it happened:

My email to Treasury Direct about my unbelievable 0% Bill

Hi,

I bought a bill using the express module. I was checking out the bill I invested in, but I see that it is at 0% interest? How can that be? Is that a bug on the site or did I really just give 100 bucks to the government to hold on to for me for 4 weeks at no return?

Thanks,

Eli

Their Response to my email:

Hello Eli,

Yes, you are correct the interest rate for four week bill’s is currently 0%.

Thank you,

<Name Purposely Removed>

Customer Service Specialist

Well as you would have guess that left me quite puzzled, after doing some research I fixed that. I do most of my best learning by trial and error… this just happened to be a really stupid way of finding out. Needless to say I will never make that mistake again, plus it was my motivation for this article.

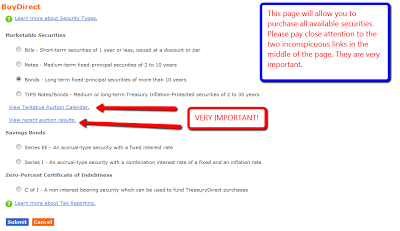

How to Purchase Stuff Normally

|

| 1. Click on the “BuyDirect” link first |

|

| 2. Use this page to make your purchases |

In order to purchase your securities you want to select something from the radio button list and press the submit button. I have only worked with Bills and the Series I Bond so far. Purchasing the security is not the hard part, it is understanding the gravity of what you are purchasing that is difficult since the rates are not displayed for you at the time of purchase. You have to look that information up before purchasing anything.

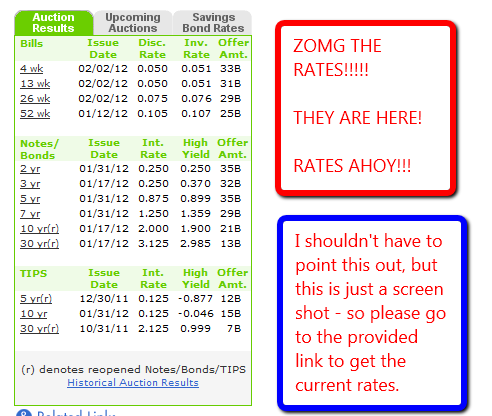

Where do I find the Rates?

The links for the rates are inconveniently and inconspicuously scattered all over the site and unfortunately since it is a link it is hard to spot since it blends in with all of the other links that you are looking at on the site. The developers really should have made it an image link – that is my biggest gripe about this site – understanding that the rates are on a different page all together! I really think they should show up at the time of purchase, logically I think that would make more sense than the user having to cross reference the rate themselves and still not being completely confident that – that was the correct rate.

So for your convenience here are the links:

Tentative Auction Calendar – This is a PDF

Auction Results – This link shows you rates

EE/I Savings Bonds

Savings bonds are a lot like Savings Accounts except that your assets are not liquid and there are penalties for getting your money back before maturity. So savings bonds are a hell of a lot more like Certificates of Deposit in my opinion, but again I am not a financial expert so if I am wrong forgive me. Just an observation…

Before you purchase these securities you should really know the following:

- You can purchase either security for a minimum of $25 and a maximum of $10,000 dollars.

- Your purchase will not be redeemable (you can’t cash out) until at least 1 year.

- If you redeem your bond before 5 years you will have to forfeit 3 months of your latest interest earnings (there are exemptions).

This information is here:

I-Savings Bonds

EE-Savings Bonds

Conclusion

I think the Treasury Direct site needs to be MORE clear about some of these things before someone takes the plunge. I am sure some people disagree with me, but from an ease of use point of view – this site is far from it. It is not friendly and you can pretty much screw yourself if you don’t know what you are doing. The information I am pointing out above should be available at time of purchase.