Introduction

There are things no one tells you when you get married, one of which is doing taxes almost becomes impossible to do and is one of the most frustrating experiences I have had to endure to date right behind moving, buying a house (still not finished with that one) and taking final exams. I am going to steer clear of the political side of this issue, but one thing I think EVERYONE can agree on is our Tax system is definitely confusing and not fun to use.

Oh Expletive! I just shot myself in the foot!

I recently had the misfortune and finding out the hard way that I owe a gigantic sum of money to the IRS and I have no one else to blame but myself because I filled out my W-4 a specific way. I cannot use the word “wrong” because I didn’t fill it out wrong. I put my marital status down as married and I claimed 2 for my allowances. I used the provided worksheet and it made sense to me when I was doing it. Well like they say, hind sight is 20/20…

Recommended W-4 Configuration

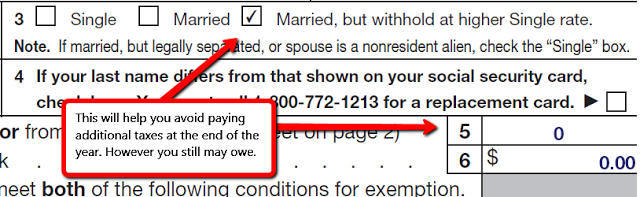

Everyone has a different tax situation – I am just sharing my experience – I am not a tax expert in any capacity. That being said, I am recommending that if you want to avoid owing a lot of taxes at the end of the year that you check off the box that says “Married, but withhold at higher Single rate.” in section 3. I recommend having NO allowances, meaning you are going to put the number ZERO in section 5.

|

| Every time the IRS see’s that someone marked off “Married” alone they are probably ROFLing. |

This indeed sucks because you see less in your paycheck throughout the year – but this is money you would have to pay regardless at the end of the year. So really it comes down to choice – choose your W-4 poison. Lastly – if you don’t pay enough taxes during the year you are charged a penalty when you file.

Wait! There’s More Bad News!

There is a very tempting option when filing your taxes to file “Married, but separately”. Well prepare to laugh because it isn’t all that great. It is nothing like filing as Single. I learned a few crappy things this round of taxes and that is…

…If you want to file Married, but Separately:

- You are giving up your 1098E which is your student loan interest if you have any – you cannot legally claim it.

- You cannot contribute to your Roth IRA because chances are you make more than 10,000 dollars – it is ILLEGAL for you to make a contribution and you will be charged a PENALTY of 6% on the contribution amount for every year that you do not remove it from your Roth IRA.

- Your tax rate is completely different which of course depends on your AGI or Adjusted Gross Income.

I’m sure there are more disadvantages to filing this way, these are the only ones I had so far.

What does this all mean?

The IRS really really really wants you to file Married and Jointly – not separately. If you file Jointly you can claim your 1098E and your contribution limits to your Roth IRA are dramatically higher so you won’t be penalized. Your tax rate is completely different yet again which is now adjusted depending on your joint AGI.

I heard I can file for an Extension…

Yeah you can file for an Extension… but it is only for an extension that gives you more time to FILE your paperwork – NOT pay your taxes due! GOTCHA! This is a very misleading pitfall, if you don’t pay your taxes due you will be charged a penalty and interest. Right from the horses mouth here.

How do I calculate my Tax Rate?

This is a very nifty tool, but it is only Accurate and for estimation: Tax Act’s Tax Bracket Calculator you just need your AGI which you can calculate by adding up all of your W-2 gross income and selecting the correct filing status. This is particularly helpful to let you know if you underpaid. The tax rate and tax amount shown in the calculator is your Federal Income Tax ONLY!

Not all Taxes are Treated Equal

There are three main taxes we all pay dubbed the “Payroll Taxes”, the IRS only cares about 1 of 3 of those taxes when they are telling you how much you owe. The three taxes are: Federal Income Tax (FIT), Medicare Tax and Social Security Tax (SS). When you are calculating how much you owe, you can forget about including Medicare and Social Security in the total amount of taxes you paid – they do not count. Therefore when calculating what you owe – the only tax that matters is the FIT.

Conclusion

CYA – make sure to pay all of your taxes ahead of time and keep some money around for later just in case you owe money. There are payment plans – but they come with penalties and interest so don’t do this unless you don’t have a choice. The worst thing you can do is NOT pay.

Sources

- I got a majority of my information from using Turbo Tax.

- IRS Website

- Filing my taxes